|

|

|

REDUCING TAX ON A SUPPLY CHAIN – 2

Source : JFU

19 June 2012

Collaboration of traders to prevent leakage of tax credits

We suggest in our last Note the focus of VAT management should be on minimizing the loss of input credits in order to reduce the overall tax burden on a supply chain. To achieve this, traders in a supply chain must collaborate. Let us explain this view with four simple input output tables which, with the exception of VAT status of the intermediate traders, represent four identical supply chains. Each supply chain comprises five traders before the good they produce reaches the final customer in the final market. Thus, there are four intermediate transactions between the traders plus the final transaction of selling the good to the consumer.

China adopts a consumption based VAT system where consumers buy goods at a tax inclusive price; that is, the price tag and sale invoice do not show how much tax consumers pay. Thus, the price is the amount consumers are willing to pay without having regard to the underlying tax. Vendors in supply chains selling identical goods in comparable circumstances have to set the same tax inclusive price if they want to achieve the same level of sales. Their profits however may differ depending on their respective input costs. In this note, the focus of our interest is how their profits may differ in terms of tax cost.

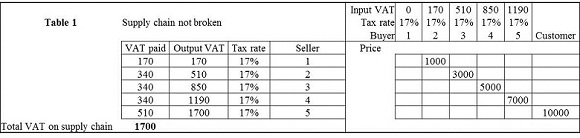

The supply chains as represented by the four Input-Output tables all sell an identical good at the same market price of 10,000. The starting cost of input of the first trader in all cases is the same at 1,000 and the amounts of value added at all the intermediate stages of production and distribution are also the same, resulting in the same ex tax intermediate prices of 3000, 5,000, 7,000. Note that, in general, China's VAT system requires intermediate traders to trade at the ex tax price, with each trader in effect an agent for collecting and paying tax according to its own value added. Where all five traders are registered VAT payers, the total amount of VAT paid at the standard rate of 17% on the good produced by the supply chain is 1,700 shared by traders based on respective value added as follows: trader 1, 170, trader 2, 340, trader 3, 340, trader 4, 340 and trader 5, 510. See Table 1.

Table 1 illustrates a scenario where all the traders collaborate to ensure the entire supply chain maintains an unbroken value added tax chain so that the total tax on the supply chain is equal to the final output tax on the final sale. That is, 1,700, which we are going to show is the minimum amount of tax on a supply chain for domestic production and consumption.

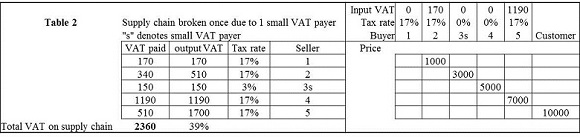

Table 2 illustrates another scenario where one of traders (trader 3) does not register itself as general VAT payer but a small payer. Trader 3 does pay less, 150 instead of 340, but its saving is achieved at the expense of other traders; trader 4 in this illustration. The tax administration actually collects more, 2360 or 39% above minimum. In reality, we would expect trader 4 could negotiate with trader 3 for a lower price, but this cannot change the result that the overall tax on the supply chain is still more than the minimum of 1,700.

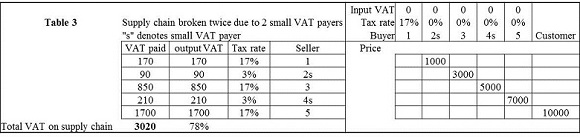

Table 3 illustrates a different scenario where there are two small VAT payers along the chain, trader 2 and 4. The effect is more obvious and drastic, with the amount of total tax burden increased to 3,020 or 78% above minimum.

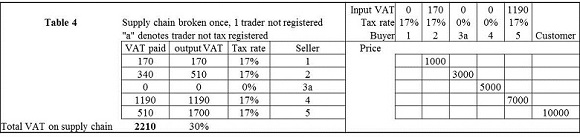

Table 4 shows a scenario where tax fraud occurs. Interestingly, the tax administration does not suffer from collecting less tax. In this illustration, trader 3 perpetrates the fraud but trader 4 pays more. In reality, one would also expect trader 4 could negotiate for a lower price for not being able to obtain a VAT invoice. But again, this would not change the result that the overall tax on the supply chain is higher. That is, it is the other traders who are cheated by the tax fraud perpetrators.

The moral of the above illustrations is twofold:

1. From taxpayers' perspective, all players in a supply chain must collaborate to preserve the input credits. Thus, key players in particular supply chains have to act to align the interest of all for tax purposes, as for other purposes such as cost control, quality and customer satisfaction.

2. From the tax administration's perspective, the enforcement effort can be focused on collecting output tax on final sales and auditing evidence of corresponding input tax credits. The rationale for this being that all the players in a supply chain, probably with key players playing a bigger role, would align themselves in compliance as a matter of self interest.

|

|

|

Please contact us

for more information

Tel: +(852) 3719 6000

|

|